What is Incentive Compensation?

Incentive compensation is the financial reward structure for motivating employees to elevate their performance. Frequently we think of incentive compensation in the context of commissions on sales, but they can also include annual bonuses, shares of stock, and more.

On-Target Earnings (OTE)

On-Target Earnings, or OTE, are the combination of one’s fixed base salary and variable compensation, such as commission or bonus, that when goals or quotas are met, combine to form the total compensation.

Why is Incentive Compensation Important?

Ultimately, incentive comp ensures that the team understands the importance of their incremental contributions and can narrow their focus on achieving their goals, milestones, or quotas efficiently.

Below are the top four reasons why we believe having a good incentive comp strategy in place is important:

1. Reward Reflects Performance

Incentive comp establishes a meritocracy where pay is aligned with effort, performance, and achievement.

Meritocracy helps maintain fairness among the team since those that outperform others shouldn’t receive the same compensation as the underperformers. Consider a restaurant that pools tips — this doesn’t incentivize extraordinary service because the servers know their tips will be diluted by their underperforming co-workers.

2. Motivation

Having skin in the game motivates the sales team to work harder and strive to achieve their quotas, even if only to boost their personal agenda: more money. Many incentive comp plans include stock or stock options, which elevates one’s role from employee to owner.

As an equity owner, the long-term incentive to deliver value in one’s role is measurable (in the underlying price of the shares) and widely understood. Compared to an hourly or salary worker who has only short-term incentives to perform, having additional incentives to motivate ongoing performance can bring out the best from the team.

3. Attract and Retain High-Performers

It’s a continuous feedback loop: competitive OTE attracts A players, who attract other A players, and the competitive nature of the work makes for a fulfilling environment, driving employee retention.

While competitive OTE can attract top talent, it’s important to understand both sides of the incentive comp coin. If quotas are unrealistic, for example, you will compromise your team’s ability to hit their goals and subsequently their target earnings. This will lead to frustration and animosity on your sales team.

Quota attainment differs for inside sales and outside sales reps, but between 55-65% of reps report regularly achieving their sales goals. Having a slight majority of reps achieving their goals and their OTE is a good benchmark because it helps motivate lower-performing reps by showing them it is possible.

4. Compensation Intangibles

As we’ve discussed, incentive comp and quota fairness specifically is important because they play a big role in overall job satisfaction. If you feel you are not being fairly compensated, supported, or equipped by the company to achieve your quota, then you’re not likely to rate your quota fairness, or satisfaction with the company, very highly.

These are important metrics to pay attention to because, like a net promoter score, they are good indicators of how likely your reps are to recommend your company to their network as a great place to work, which can impact recruiting.

Types of Incentive Compensation

There are a number of compensation package strategies that can incentivize employees to join a new team and keep them satisfied within the company.

Base Pay and Salaries

Many people ask if salaries are included in incentive pay. We do believe base salaries help incentivize loyalty, goodwill, and a sense of security among team members; but they can also instill a sense of complacency.

It’s important to balance base salary with variable compensation to maximize motivation without compromising your team’s security. In markets like San Francisco and New York City where cost of living is exorbitant, you want to make sure the base salary covers at least the bare-essentials, because if your team fails to achieve their goals in a given period, you don’t want them to be destitute.

Commissions

A commission is a percentage or flat fee paid to an employee for their contribution to a sale. Many sales reps, managers, and executives make a significant portion of their income from commissions. In our analysis of ten companies, 42% of average annual income came from commissions.

Companies benefit from including a commission structure in their comp plans because the additional expenses are offset by the increased revenue. Essentially, the company removes the risk of higher fixed operating costs by offering commissions.

According to Compgauge data, 99.1% of sales reps received commissions of some kind in 2020 and 2021.

Profit-Sharing Bonus

This incentive comp strategy is often most noteworthy for a company’s leadership or upper management, but it can trickle down to individual sales reps and other employees.

Profit-sharing rewards the team, typically on an annual basis commonly referred to as a “holiday bonus” or similar, for delivering on their goals and the goal of the entire company: revenue growth.

Signing Bonus

When attracting top talent to join your sales organization, it can be helpful to “sweeten the deal,” so to say, with a one-time signing bonus. Offering a signing bonus is usually deployed when you want to entice talent to leave their existing role to join your company or to persuade someone that has many offers to choose yours.

Stock Options

Even sweeter, and more long-term, is the opportunity to receive stock or stock options to incentivize the team to operate efficiently while growing aggressively, maximizing the underlying value of their equity.

Fringe Benefits

Fringe benefits are the perks that come with employment but don’t necessarily directly result in an increase to annual compensation. Some examples of fringe benefits include:

- 401K matching

- Paid time-off

- Paid parental leave

- Insurance

- Subsidized meals, snacks, and drinks

- Commuting assistance

Employee Incentive Programs

In some cases, it can be beneficial to generate a healthy competitive spirit on the team — with the added benefit of increasing revenue — by organizing incentive programs like sales contests with sought-after prizes.

A leaderboard style competition, for example, can push the team to compete with themselves in full transparency. Although, everyone wins with the increased revenues, commissions, and job security.

Incentive Comp Lessons From Real-World Sales Organizations

We were interested in how some of the top-performing sales teams in the world structure their OTE and incentive comp programs. We picked ten of the most successful publicly-traded and private companies and analyzed self-reported data from their sales teams.

This includes data from Compgauge, Glassdoor and revenues of the publicly traded companies from Yahoo Finance. Compgauge allows sales professionals to self-report on a number of factors including base salary, commissions, signing bonus, stock options, and more. One metric they ask reps to report on is their perceived “quota fairness,” which is what we used to find an average quota fairness for each company with 10 being the most fair quota and 1 being the least fair.

We also analyzed job satisfaction for the sales team using Glassdoor, filtering the ratings and reviews by job function to get the sales team’s overall satisfaction compared to the entire company, which you will see represented as either a lower (▼), equal (◼) or higher (▲) job satisfaction.

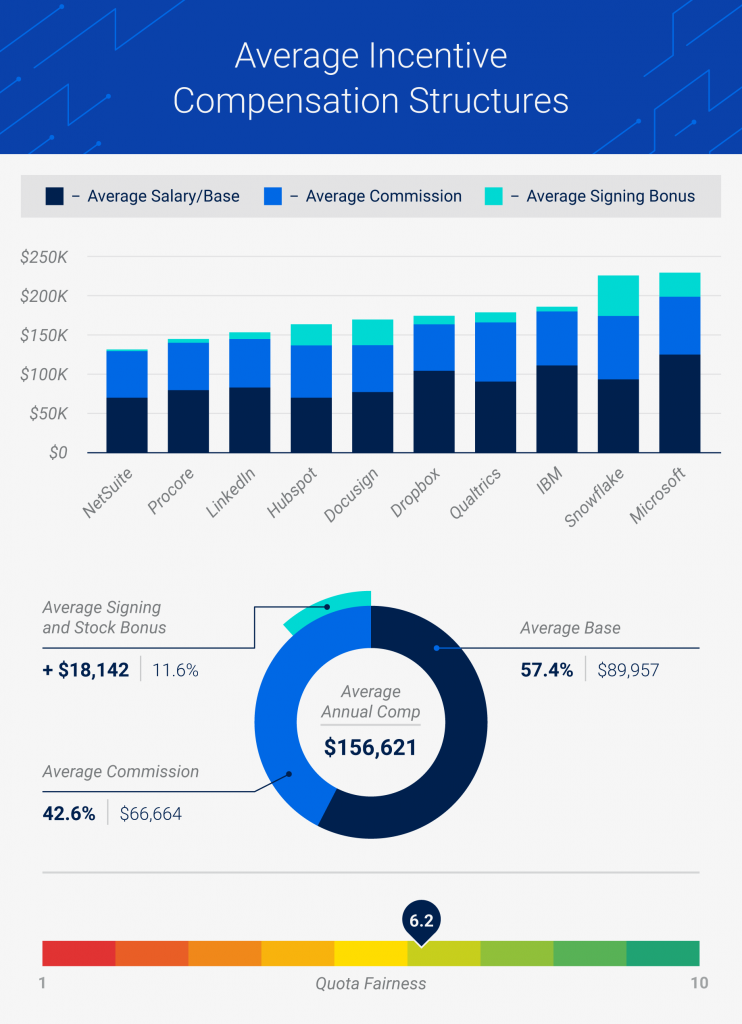

Average Incentive Compensation Structures

Keep in mind that OTE will vary based on the company’s target market. Companies that sell to small businesses will typically have lower OTE than companies that sell to large enterprises.

As you can see, the average base salary accounts for nearly 58% of a sales person’s annual compensation and commissions account for the remaining 42%. The average OTE for all sales roles within these ten companies is $156,621. The average signing bonus and stock plan is worth an additional 11% of one’s annual compensation, on average.

Below, we detail each of the ten companies, their annual revenue and growth, as well as their incentive compensation strategies.

NetSuite

NetSuite was founded in 1998 to provide finance, operations, and customer service software to businesses. NetSuite went public in 2007 and in 2016, was acquired by Oracle for $9.3 billion, despite the controversy that Oracle’s founder, Larry Ellison, had personally invested and owned 40% of NetSuite.

Zach Nelson, the former CEO of NetSuite, was infamous for growing the company from $1 million in revenue to a $1 billion run rate. Here is what he said about building NetSuite into a durable business:

“A study done by Ari De Gues found that long-lived companies share characteristics such as having a strong vision, making wise investments, and valuing the people brought into the company. Those three things are what we really try to focus on at NetSuite.”

Given NetSuite deals with many SMB customers, it’s not surprising total compensation for NetSuite’s sales team is on the low end of pay among the companies featured here, but they do offer a secure base salary and decent opportunities for large commissions.

The sales team rates their satisfaction on Glassdoor slightly lower than the rest of the NetSuite team (3.7/3.8 ▼) and quota fairness is rated at 5.5, which likely means the sales team is given aggressive growth targets.

Procore

Procore Technologies is a construction project management software company founded in 2003. The company is currently private, but filed documents with the SEC in February of 2020 to go public.

According to those filings, the company generated $400 million in revenue in the fiscal 2019 year, up 38% YOY. The customer growth rate is also significant, which validates their incentive compensation strategy. The sales team also reports higher than average job satisfaction compared to the rest of the company (4.5/4.3 ▲).

LinkedIn is a professional networking and employment site that was founded in 2003, went public in 2011, and was acquired by Microsoft in 2016 for $26.2 billion.

Although their total compensation is on the lower-to-middle end of our featured companies, their average base salaries are a relatively large portion of total comp, at 57.5%. Their commissions aren’t too far behind and their quota fairness score is the third highest among our featured companies.

LinkedIn also had a job satisfaction on their sales force equivalent to the rest of the team (4.3/4.3 ◼).

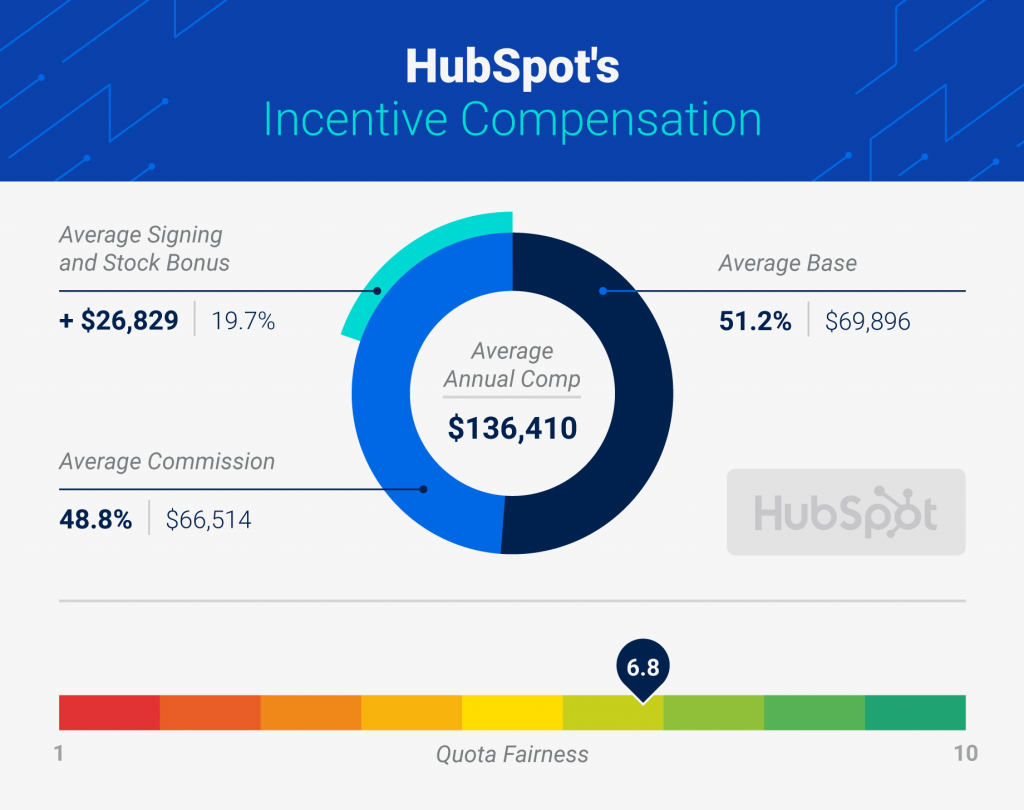

HubSpot

HubSpot was founded in 2006 and has built a suite of products for inbound marketing, sales, and customer service. Although their annual revenue is less than a billion dollars (only ordinary in the context of this analysis) the last two years have each seen 30% YOY revenue growth.

The incentive comp strategy for HubSpot is essentially split equally between base salary and commissions. They also have a significant signing bonus or stock option plan that adds nearly 20% to one’s total compensation.

The sales team reports a higher than average quota fairness and slightly higher Glassdoor review compared to the rest of the company (4.8/4.7 ▲).

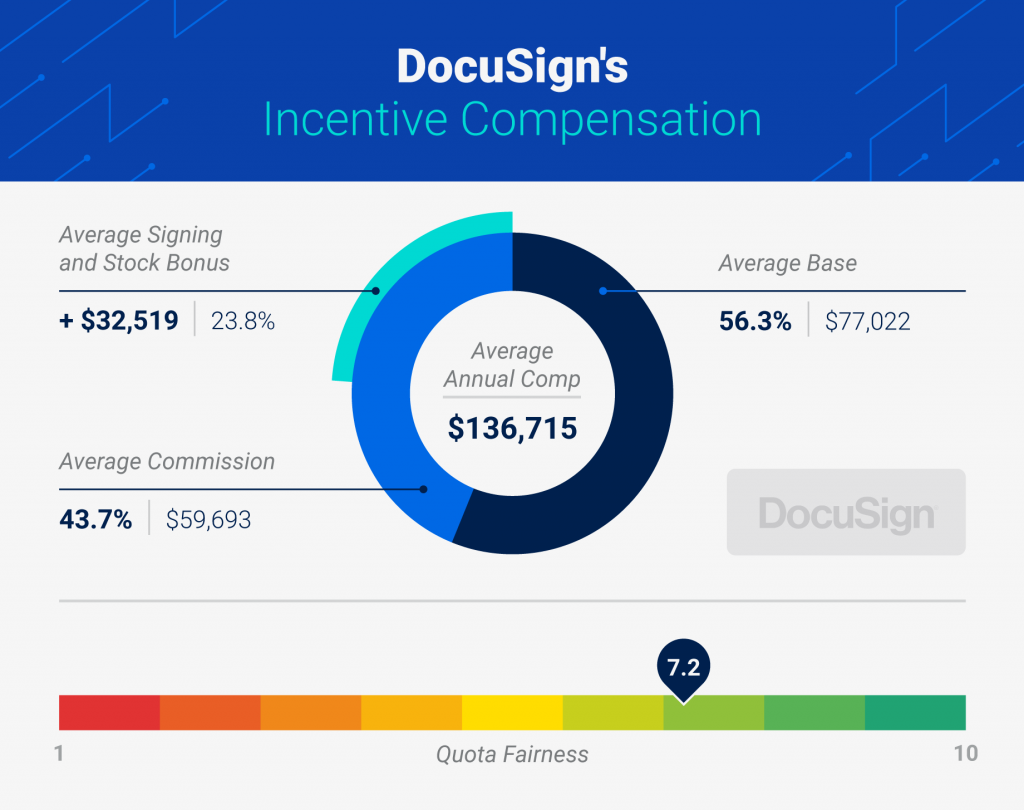

DocuSign

DocuSign, a cloud based e-signature B2B software company that was founded in 2003, had trailing twelve month (TTM) revenues of more than $1.45 billion as of February 2021. Their sales team is obviously highly motivated as their YOY revenues grew by 49%.

Incentive comp for DocuSign includes an average base salary that comprises 56.3% of OTE and commissions cover the remaining 43.7%. They also have a significant signing bonus and stock option package that comprises nearly 24% of the total earnings.

DocuSign’s sales team had the highest quota fairness rating of any company in our study and salespeople report a level of job satisfaction equivalent with the organization as a whole on Glassdoor (4.7/4.6▲).

Dropbox

Dropbox is a file-sharing service that was founded in 2007 and has annual revenues approaching $2 billion. Their sales team has been driving predictable revenue growth of 19% from 2018 to 2019 and 15% from 2019 to 2020.

Their average base salary is one of the highest in our analysis by percentage of total earnings, totaling 63.3%. The remaining 36.7% is covered by commissions for an average OTE of around $163,000.

The Dropbox sales team rates their quota relatively fair and the sales team’s Glassdoor rating is 0.2 higher than the rest of the company (4.0/3.8 ▲).

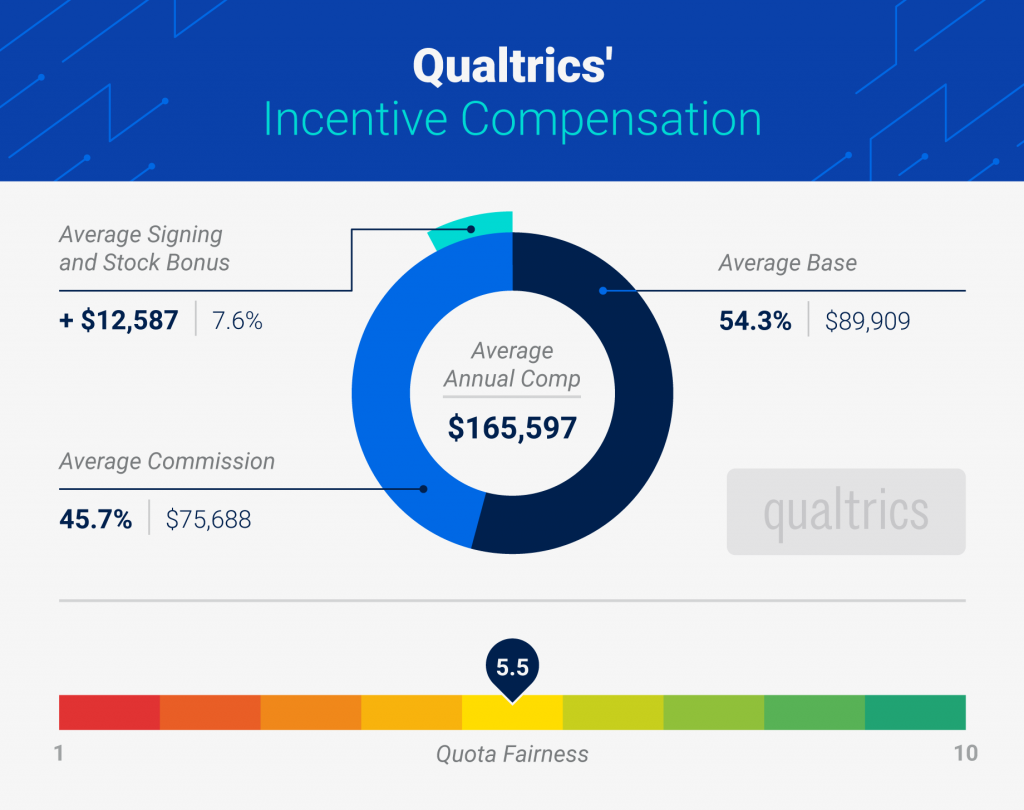

Qualtrics

Qualtrics was founded in 2002 and acquired by SAP in 2018 for $8 billion. In January 2021, SAP took the company public, highlighting its YOY growth of 29% from 2019 to 2020, bringing annual revenues to more than $763 million.

The sales team for Qualtrics receives 54% of their OTE from base and about 46% from commissions, bringing OTE to more than $165,000.

Their sales team’s satisfaction level are on par with the broader team (4.1/4.1 ◼). It also appears Qualtrics sets relatively aggressive sales quotas given the average quota fairness score as reported by reps.

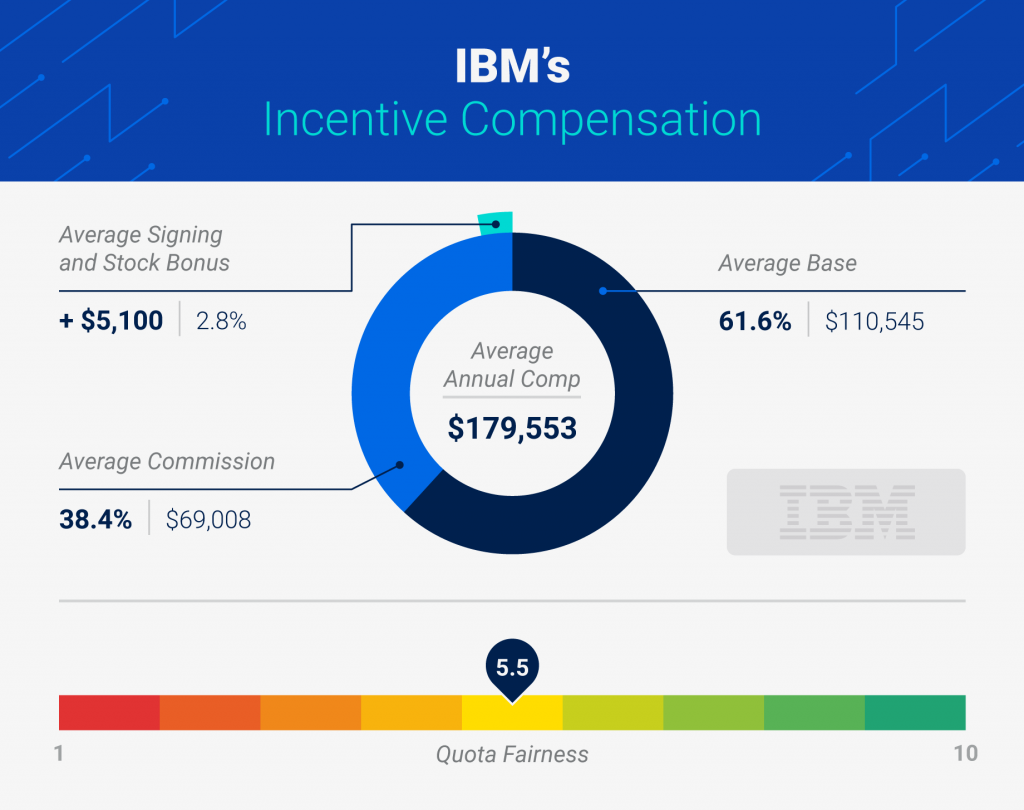

IBM

By far the oldest company in our analysis, International Business Machines was founded in 1911. Although their annual revenues are more than many of the companies featured here combined, revenue has been declining by 3-5% annually for the last couple of years.

It’s interesting to note that IBM’s average base salaries for their sales team are second highest among the companies in this study at $110,545, and third highest as a percent of total compensation.

It might be a coincidence that a company with declining revenues also has a higher than average base salary but it does add anecdotal evidence for relying less on fixed salaries and more on variable incentive comp strategies like commissions.

Another interesting thing to note is that quota fairness is reported relatively low for IBM, which could be a result of overzealousness from leadership or missed goals and hurt egos. They also had a lower than average Glassdoor rating for their sales team, compared to the company at large (3.8/3.9 ▼).

Snowflake

From the oldest company in our analysis to the youngest — Snowflake is a cloud-computing data warehousing company founded in 2012. Revenue in 2020 was $592 million but the YOY growth rates of 123% from 2019 and 173% from 2018 are a testament to a high performing sales organization.

Snowflake’s total incentive compensation is the second highest among the ten companies in our analysis which is likely due to Snowflake’s enterprise-level deal sizes. They also offer competitive signing bonuses and stock plans, a benefit of being a young, growing, and well-capitalized company.

One can almost see Snowflake’s staggering revenue growth rate reflected in the sales team’s quota fairness and Glassdoor rating, which is lower than the rest of the company (3.6/4.2 ▼). Here is a quote from a former employee on the sales team:

“It can be a grind but only the greats persevere.”

Microsoft

By far the largest and most valuable company among this list, Microsoft was founded in 1975 and has grown to develop and serve many verticals in the personal and business technology markets. TTM revenues are more than $153 billion and have grown by 13-14% over the previous two years.

Among the companies in this analysis, Microsoft pays their sales staff the highest total compensation, on average. They also have the largest average base salaries of any company featured at $124,108. In addition to this, they have the third highest quota fairness rating but their sales team reports slightly lower than average job satisfaction compared to the rest of the company (4.3/4.4 ▼).

Incentive Comp for Your Sales Team

We’ve all heard that job satisfaction matters more than money. It is interesting to note that the sales teams of both the company with the highest and the lowest total compensation rated their job satisfaction lower than the rest of the company.

This insight led to one of the most interesting takeaways from this study: companies on the lower- and higher-end of compensation had lower satisfaction ratings among their sales team. The “goldie-locks” companies that more closely aligned to average incentive comp plans were more likely to have higher than average satisfaction and quota fairness ratings.

We believe this indicates that sales people just want to be compensated fairly for the work they do. If you are trying to offer your sales team huge comp plans but at the cost of work-life balance and job satisfaction, you might just get what you pay for.

If instead, you leverage a workplace meritocracy that adequately rewards performance and provides your sales team with the tools and support to get their job done effectively, you will almost certainly build a long-lasting and exceptionally talented sales team.